‘The excavation was a financial success’ | Irish Commercial Archaeology in 2015

|

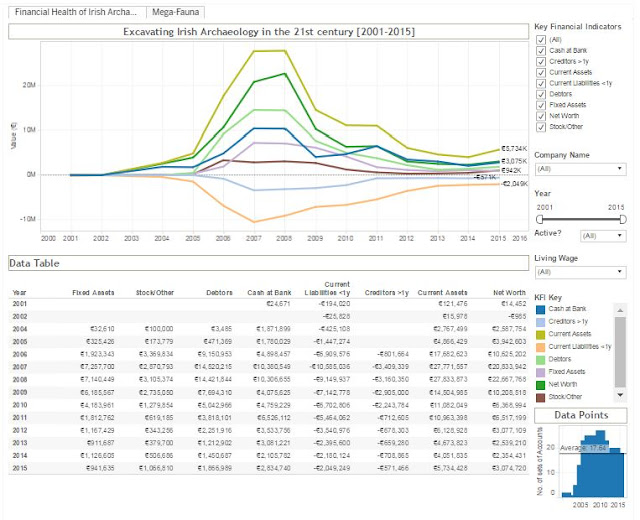

| Screenshot of the Tableau Dashboard. Available [here] and at the end of this post |

Background

Archaeologists are

supposed to be rather good at digging … out in the field it’s quite a bit of

what we do. When I left field archaeology in 2011 it was, I suppose, inevitable

that I would find something else to delve and dig into. One of the topics that

has engaged my attention in recent years is the reconstruction of the financial

histories of individual archaeological consultancies to create an impression of

the sector as a whole, based on a few publicly available ‘Key Financial

Indicators’. The process started with an examination of Northern Ireland’s four

archaeological consultancies for the period from 2007-2013 [here]

and, while imperfect, was sufficient to plot much of the post-2008 collapse of

the industry, even if the 2013 data was only for a single company. A second

post [here]

updated the dataset with the 2013 financial details of two further companies.

My original point in this was to demonstrate the financial fragility of the

sector and underline the dangers this posed for excavated archives, should one

or more company declare bankruptcy. The approach proved popular with many

archaeologists (though perhaps not with the company owners themselves) and I

was prevailed upon to extend my analysis to companies in the Republic of

Ireland [here].

At that time, the data ran from 2001 to 2014. It was at this point I also introduced

the use of Tableau dashboards that allowed the user to interact directly with

the data and create their own dynamic visualisations. An advantage of this was

that it allowed the user to replicate and interrogate my methods, along with

allowing them to drill down to the information most pertinent to their own

interests. In a further post [here]

I updated the Northern Ireland story to include 2014 data. I then took the

decision to pay for access to the Summary Accounts submitted by individual

companies to Companies House. Although relatively expensive, the access allowed

me a more granular view of the individual accounting categories that made up

the high level KFIs. It also gave me the opportunity to extend the historical

view back to 1998 (and for one company, up to 2015), thus charting the rise of

the commercial archaeological sector as well as its fall. My most recent work

on the topic [here]

has expanded the Northern Irish dataset to include 2015 results for two further

companies. For this iteration of the report I was persuaded to drop my earlier

attempts at obfuscation and name actual companies. All this concentration on

the Northern Irish scene has reminded me that I have neglected the financial

landscape of the Republic of Ireland. This post seeks to remedy that situation.

What’s New?

Following the precedent

set in the last update of the Northern Irish data, this iteration of the

dashboard will no longer use a Three Letter Acronym (TLA) to obfuscate the

names of the companies. The actual company name will appear in the Company Name

filter, if occasionally shortened to fit the space available. The list of Key

Financial Indicators has been expanded from four to eight, the same as the NI

dataset. While I felt that there was much to recommend the graph of Average

Values, it was very small and difficult to read. For this reason I have dispensed

with it entirely, to free up space for the expanded data table. The Data Points

graph, indicating the numbers of accounts submitted per year, while valuable,

didn’t need quite so much space to be effective. It has been moved to the

bottom right-hand corner, again, to provide more space for the data table. The

calliper filter to select the Year, and the dropdown to switch between the

active and inactive companies (or both together) remain. However, a new Living

Wage filter has been added. This allows the user to exclude/include companies

that have agreed or refused to sign up to the Living Wage initiative. A third

category exists for companies who have yet to be contacted for a response.

Finally, available accounts for the Galway-based Arch Consultancy run from 2005-2103, but were not previously in the

dataset. Previous iterations of the dashboard have been confined to a single

tab, but here I’ve added a second (termed Mega-fauna) to examine the unequal value

of One Company against Everyone Else in the sector.

The 2015 Data

Some 20 companies

submitted 2014 accounts that are available to me. For 2015 this number dropped

to 18. Four of these companies did not (or have not yet) submitted 2015

accounts: Lane Purcell Archaeologists; Association of Archaeological

Consultants of Ireland; Eachtra Archaeological Projects; Moore Archaeological

and Environmental Services. Of these, Lane Purcell Archaeologists have

submitted a Request for a Voluntary Strike Off and may be considered to have

ceased trading, though they have not formally been dissolved. The Association of

Archaeological Consultants of Ireland company have now been dissolved. In the

previous iteration of this dataset, 2013 was the last year I had summary

accounts for Moore Archaeological and Environmental Services. This has now been

updated to include 2014. Interestingly, this company was dissolved in May 2016,

but applied for restoration in July 2016. Two further companies submitted their

first sets of accounts in 2015: Shanarc Archaeological Consultancy and Archaeological

Service Providers.

Archaeological

Development Services last submitted accounts in 2012 and have a number of

documents on file regarding the liquidation of the company. However, for

whatever reason, they appear to still be considered as active by Companies

House and I have (not without reservations) mirrored that designation. The

previous version of the dataset contained 2015 accounts for Valerie J Keeley

and these (obviously) are retained. This company too is listed as Active, but

the documentation includes notices of Voluntary Winding Up and the appointment

of a Liquidator.

Analysis

As there are too many

companies in the RoI dataset, I don’t propose going through them one by one, as

I did for the NI consultancies. Instead, I want to look at overall figures and

trends about how the sector is performing as a whole. Anyone interested to

examine the changing fortunes of any company at an individual basis will find

the tools to do so on the dashboard.

As I have done before, the

discussion will include data only from companies still considered commercially active.

Although I recognise that this somewhat limits the full historical perspective,

it does have the advantage of centring the discussion on only those entities

actively excavating sites and providing employment. In terms of Fixed Assets,

2015 saw a slight decrease in value from €1.13M to €941K.

It is broadly in line with the €911K recorded in 2013, and while it

represents some form of short-term stability and continuity, it is indicative

of a lack of recovery from historic highs of €6.9M recorded in 2007. The

Stock/Other category includes investments and works in progress and can

incorporate some rather disparate assets that are hard to otherwise categorise.

That caveat aside, it is clear that this category has shown a remarkable

increase to €1.06M in 2015, up from €0.5M the previous year, and the historic

low of €343K in 2012. Once again, the figure is well below the historic highs

of nearly a decade previously when the total hit €3.2M in 2006. Debtors also

show a healthy increase in 2015 to €1.86M, from a 2013 low of €1.21M. This is

well below historic highs of €9.98M and €10.3M in 2007 and 2008, respectively.

Debtors are an interesting and, potentially, double-edged category as the

figure records work billed for, but as yet unpaid. It’s money that (all things

being equal) is coming your way, but you don’t actually have it in the bank. In

a healthy financial environment, this should be only a minor consideration, but

in less certain economic times it is eminently possible that such funds may

never materialise. This may be either be through the debtor being unwilling or

unable to pay, leaving the company with a reduced cash flow and, in turn,

unable to pay their own debts. I will return to this point in due course. For

the moment, looking at Cash at Bank, 2015 appears to have been a relatively

successful year with a total of €2.83M recorded, up from €2.10M in 2014, and

broadly comparable to 2013s €3.08M. While a strong performance, the figures are

well down from historic highs of €5.12M in 2007 and €6.52M in 2011.

One of the advantages of access to the

summary accounts, rather than just the high level KFIs, is that it allows us

see how creditors can be broken out into two sub-categories – those that are

payable within the coming year and those that are payable within a timescale

greater than one year. The Current Liabilities payable within the coming year

were recorded at -€2.05M in 2015. This is an improvement on the -€2.18M from

the previous year, and significantly better than 2007s historic highs of -€9.75M.

Creditors to be repaid outside of the current year usually includes business

loans and the like. In 2015 this figure was recorded at -€571K and has remained

relatively consistent since 2011s total -€712K. These figures represent a

significant recovery from the high of -€3.4M returned for 2007. Gross Current

Assets would, ostensibly, read like a good news tale of recovery in 2015 to

€5.73M from a low the previous year’s total of €4.05M. It may even be hailed as

the first step back after a seven-year decline from 2007s record €17.75M. But

that’s not the whole story. As noted in previous posts, this figure is in part

composed of the monies owed to the companies by their debtors. It bears

repeating that this is work that has been carried out, but has yet to be paid

for, and in uncertain financial conditions may never be paid. For this reason,

I’ve introduced a simple calculation to demonstrate the percentage of the

Current Assets that are composed of unsecured debtor value. Of the 19 companies

who submitted accounts in 2014, and are still listed as active, this figure

ranged from 0% to 189.16%, with the mean being 55.18%. This may be compared to the 18 Active

companies who submitted 2015 accounts. Here the figures ranged from 0% to

97.62%, with an average of 47.48%. While still relatively high, the situation

does appear to be improving in this regard. The final KFI is, of course, the

summed Net Worth of the sector. The 2015 figure is €3.07M and it is the first time

since 2008 (€12.51M) where it is an increase on the previous year. While it may

be seized on as a positive sign, and an indicator of steps towards prosperity,

I would caution that it is a single year’s results that could yet go either

way.

Mega-fauna

Taken together, the

KFIs are mostly going in the right direction. Net Worth, Current Assets, etc.

are all improving, while levels of debt appear to be under control. Probably

even more importantly, the average percentage of Debtor value that makes up

part of the Current Assets calculation appears to be at manageable levels and

has decreased since last year. This looks like an industry on the cusp of a

full recovery. Even the fact that there are 18 companies dividing the sector

between them appears to give the impression of vibrancy. But that’s not really

the case. In my

previous post on the financial histories of the Irish consultancies I noted

that the years 2008 and 2009 would appear to be “nothing less than an

extinction-level event for the Irish commercial archaeological sector”. In that

time a significant number of the large consultancies either shut up shop, or

were vastly reduced in their circumstances. While some of smaller companies

have emerged and adapted to fill the financial niche, the sector is still dominated

by a just one “great predator”. To give

an indication of how much this one company (who I shan’t name, but we all know

which one it is) dominates the Irish scene, I have reconfigured the datasource

to show all the other currently Active companies combined into a single entity.

You’ll find the dashboard under the ‘Mega-fauna’ tab.

In terms of Fixed

Assets, the One Company had €235K in 2015, as opposed to €706K for the

rest. This is hardly surprising as each of the smaller companies have to

provide their own premises, vehicles, and digging equipment etc., resulting in significant

duplications. Again, in terms of Stock/Other assets and investments, One Company

has a 2015 result of €70K, far below the €997K of the combined others. The

breakdown of the Debtors is interesting – this One enterprise returned a 2015

total of €908K, not far below the €958K of Everyone Else. To put that another

way – of all the money that is owed to Irish archaeological consultancies,

almost 49% of it is owed to this One Company. This One Company has a 2015 Cash

at Bank total of €1.87M, in stark contrast to the €965K of Everyone Else –

that’s almost exactly two-thirds of the current Cash holdings belonging to a

single entity. When it comes to the Current Liabilities payable within one

year, this One Company returned a figure of -€523K, against the -€1.53M for the

combined rest of the sector. Again, putting that in context, of all the

short-term debt in the sector, this one consultancy holds slightly more than

25%. The situation is even starker when we examine the figures for Creditors to

be paid back at a term greater than one year. The 2015 figure for Everyone Else

is -€571K, while the One Company has no long term debt, and appears not to have

had since 2009. The gross Current Assets show this One group with a total for

2015 of €2.85M, just behind the €2.92M for Everyone Else. Again, this shows

that 49% of the total value for the sector is tied up in one company. It is

also worthwhile noting that the percentage of the Current Assets made up of

Debtors is 31.9% at this one firm, very slightly better than the 32.8% for the

combined remainder of the sector. Finally, the Net Worth variable indicates

that one company recorded a value of €1.58M in 2015, slightly ahead of the

€1.49M for the combined rest of the companies. Think about that for a second –

just over half (51%) of the Net Worth of the entire sector is held by a single

entity. My original comment from when I first examined this data was that “In

short, this one company is the most cash rich, is worth more, has more assets,

and fewer debts than the rest of the sector combined.” In the time since I made

that statement the only thing that has changed is the relative value of their

Fixed Assets. One other point that I’d like to draw from the relative Net Worth

graph is how this one company has fared in relation to the rest of the sector.

The Everyone Else line shows Net Worth rising to a peak of €11.3M in 2008, and

falling every year to €790K in 2014. Thus, 2015s total is the first time in

eight years where their Net Worth actually increased over the previous year’s

result. By contrast, the trajectory taken by this enterprise is one of steadily

increasing Net Worth from their first available set of accounts in 2006 (€405K)

to a peak of €1.77M in 2012. Their results in the years since are all

comfortably in the €1.5M range. The implication to be taken here is that when

the rest of the sector was doing well, they were too. But when the sector went

into post-2008 freefall they managed to effectively insulate themselves from

it. When everyone else is either a dinosaur that evolved into birds, or furry

little mammals filling the vacant spaces, this is the dino that ducked the

meteor.

|

| Net Worth for One Company vs Everyone Else. Tableau Dashboard [here] |

When faced with a large

beast marauding the landscape there are two routes that are available to the

individual. You can stay on your own and you will, in all probability, get

devoured by the creature. The other option is to band together for mutual

protection and defence. We know that in the past this included digging ditches,

putting up banks and palisaded fences, but we don’t quite need to do that

today. Instead, I have a simple plea to all current or aspiring archaeologists

in Ireland – both north and south – if you’re still working in the field and

would like to see the profession continue your choice is simple: go join the

Unite Union. The Facebook page Unite Archaeologists -

Digging for a Living Wage is your best starting point and will guide you

through the simple process of becoming a Union member. It is only when members

of the profession stand together that they can protect themselves from the predations

of large companies that control the market and ensure that a healthy and fair

profession develops. Once people are organised and motivated – with palisades

built and ditches dug – that’s when they go hunting for monsters …

Notes

For the best viewing experience of the Tableau dashboard, I would recommend going to Full Screen mode (F11) … there will be less scrolling needed!

Access the dashboard directly at the Tableau server here.

The first part of the title of this post is taken from the song ‘Dig’ by NOFX from their 1994 album Punk in Drublic. But, of course, you knew that.

Comments

Post a Comment