Green Shoots or a Death Rattle? Commercial Archaeology in Northern Ireland in 2015

Introduction

It’s that time of year

again … the evenings are dark and cold … we’ve put up the tree and are

listening to carols … you’re writing Christmas cards … and Chapple is poring

over financial statements for several archaeological consultancies … it’s

tradition!

Since 2014 I’ve tried

to keep tabs on how the commercial archaeological sector in Northern Ireland is

faring financially [here

| here

| here].

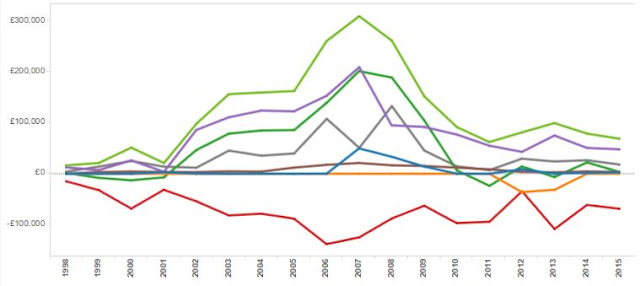

Initially, the data went from 2007/2008 to 2013 and was presented as a series

of static tables and graphs created in MS Excel. As I have added in the latest

data when it became available, I have also endeavoured to push back the start

date, to provide the most complete portrait possible. Now the data goes back to

1998 for one company and their earliest sets of accounts for each of the other

three consultancies operating in Northern Ireland. I have also moved away from

the static graphs to a dynamic, interactive visualisation of the data, created

in Tableau Public [here

and at the bottom of this post].

What’s new?

The original legal

advice I was given was that, for the purposes of transparency and

accountability, I should be open and positively identify which company is

which. I, for a number of reasons, shied away from this direct approach and

elected instead to identify each company only by its year of incorporation.

Anyone wishing to go deeper into the data would have to go to a separate

appendix and make the connections manually. However, for this new edition, I

have been persuaded that such an obfuscation is neither necessary nor

desirable. A number of people have put it to me that it is unnecessary as

everyone clearly knows which company is which and continually referring to them

by code is simply annoying.

Archaeological Development Services (ADS)[The 1990 Co]

Archaeology

Development Services have not submitted any end of year accounts since

2011. Their Facebook

page has not been updated since June 2014. The CompanyCheck

website currently [Dec 2016] lists them as ‘In Liquidation’. The UKCorporateList website

gives the status as ‘Voluntary Agreement’. The UK Government website describes

a Voluntary

Agreement as one where a company is insolvent but an agreement is reached

with creditors to allow them to remain trading while they attempt to pay their

debts. The checkbusiness

website gives their status as ‘Winding Up Order’. All these websites appear

to deal with the portion of the business operating in the United Kingdom.

However, the SoloCheck.ie website (reporting on the company operating in the

Republic of Ireland) gives their Current Status as ‘Normal’. Nonetheless, their

adsireland.ie website (listed on Facebook and LinkedIn)

cannot be reached. Earlier attempts to call them have received no answers.

Taken together, it seems that they have gone out of business … no detective

awards coming my way for that! However, I have not been able to ascertain the

ultimate fate of the contents of their storage and processing facility in

Kells, Co. Meath. Eoin Halpin, one of the company directors, gave an interview

to the BBC in 2014 that talked about the “Hundreds of

thousands of archaeological items recovered from historic sites in Northern

Ireland are lying unclassified in plastic bags and boxes”. If the company

has closed for good, what has become of all these artefacts, ecofacts, and site

archives? Unfortunately, my earlier attempts to gain answers from the NIEA may,

at best, be described as ‘unhelpful’. For the purposes of this post, I have

removed all ADS data from the discussion, concentrating solely on the financial

histories of those three companies still active.

The Overall Picture

If we sum up all the

financial activity of the tree remaining companies, we see that 2015 was a

mixed year, with relatively little to celebrate. The three companies had all of

£22,638 (Av.: £9,213) cash at bank. This is down from £29,238 (Av.: £9,746) the

previous year and is small beer in comparison to the high of £140,071 in 2007

(Av.: £46,690). Current Assets are up to £230,593 (Av.: £76,864) from £154,395 (Av.:

£51,465) the previous year. Again, this is a small-scale recovery (itself down

from the 2013 figures) and nothing in comparison to the 2008 high of £769,124

(Av.: £256,375). However, it must be kept in mind that substantial portions of

these Current Assets are made up of the amount owed to these companies by their

Debtors. While it is undoubtedly great to be owed money, this form of wealth is

somewhat less than stable and secure. While the percentages vary between the

three companies (from c.70-93%), it

is in all cases a substantial proportion of their Current Assets, and there is

little here to bring comfort. At the end of 2015 the combined debtors for the

three companies came in at £184,984 (Av.: £61,661). This is markedly up from

the previous year’s total of £98,657 (Av.: £32,886), but once again

significantly below historic highs of £551,062 in 2007 and £545,761 in 2008.

While an increase in the amount owed to the companies by their Debtors is indicative

of more work being completed, it is also of concern as it represents monies as

yet unpaid. On the positive side, the accounts indicate that none of the

companies owe longer-term Creditors (> 1 yr), recovering from historic debts

of £36,788 (Av.: £12,263) in 2012. However, the total Current Liabilities

(coming due within one year) owed by the companies at the end of 2015 was

£196,274 (Av.: £65,425), an increase from £154,750 (Av.: £51,583) the previous

year. This still represents an extraordinary recovery from the historic high of

£303,985 (Av.: £101,328) in 2013. Total fixed Assets for the companies was

valued at £9,580 (Av.: £3,193) at the end of 2015 and represents an overall

depreciation in assets with little evidence for investment from the historic

highs of £59,481 (Av.: £19,827) in 2007. The combined value of Stock/Other

assets is given as £17,971 (Av.: £5,990). Once again, this is markedly down in

the previous year’s total of £26,500 (Av,: £8,833), but above this century’s

historic low of £7,000 (2011) and insignificant in comparison to the all-time

high of £140,190 (£46,730) recorded in 2008. The bottom line is, of course, the

combined Net Worth that gives an indication of the value of the sector as a

whole. At the end of 2015 the total was £43,899 (Av.: 14,633) up from the

previous year (£10,296) and well above the historic low of -£14,976 returned in

2013. Ostensibly, the figure shows a sector in recovery, though well below

historic high of £537,276 (Av.: £179,092) recorded in 2008. If the 2015 figures

do represent the first green shoots of recovery, it must be regarded as one

that is fragile and uncertain. It in no way shows an industry performing at

anything like its past peaks. It would be wrong to completely dismiss this as a

hopeful sign, but it would be equally wrong to over hype it as solid evidence

of real growth in the sector. Only time (and more data) will tell.

While the combined and

average figures go some way to describing the commercial archaeology sector as

a whole, it is still worthwhile delving deeper into the data to see how each of

the surviving companies have fared.

Gahan and Long (G&L)[The 2002 Co]

Gahan

and Long are run by Chris Long and Audrey Mary Louise Gahan. While 2015 was

by no means spectacular, they survived and appear to have kept their heads

above water. Their Cash at Bank was given as £6,217, up from £3,663 the year

before, and £2,382 in 2013, but far below their historic high of £82,045 in

2006. There is a broadly similar story with their Current Assets, up

year-on-year from £27,269 in 2013 to £87,693 in 2015, but much reduced from the

£381,303 recorded in 2007. However, the period from 2013 to 2015 shows a

remarkably close correlation between Current Assets and the monies owed to the

company by Debtors. In 2013 Debtors owed £24,887, making up 91.26% of the

Current Assets. By 2015 the figure owed by Debtors had risen to £81,422 and

accounted for 92.85% of the Current Assets. To reiterate – it’s great to have

won contracts and gotten jobs, but it’s less good when you’re still waiting to

be paid for them. The value of Fixed Assets is given as £6,091 in 2015 and

represents the latest in a long decline from a high of £37,008 in 2007. While

Fixed Assets depreciate over time, it would appear that there has been no

strong investment back into the company. While the value of Current Liabilities

(payable within one year) had been declining from 2011 (£111,569) to 2014 (£85,870),

they have taken a slight dive to £92,849 in 2015. While somewhat concerning, it

is still much better than the debt of £144,995 recorded in 2008. From the

accounts submitted, it would appear that the company has no outstanding

Creditors to be paid back in more than one year, nor do they have any Stock or

other assets. Gahan and Long only record a 2015 Net Worth of £935, but this is

a marked improvement on the negative returns for 2013 (-£70,144) and 2014

(-£41,423). While there must be a temptation to celebrate this return to a

positive net worth, the fact remains that this result is dizzyingly far below

the ‘boom’ years of, say, 2007 (£280,440) and even 2009 (£257,938). My analysis

would be that, while there is some evidence for a return to profitability, it

is small and (in comparison to their best years) insignificant.

FarrimondMacManus (FMacM)[The 2005 Co]

Christopher John

Farrimond and Ciara Mary MacManus are the people behind FarrimondMacManus.

All things considered, they didn’t have a bad year. Their Cash at Bank was

£18,738. True, this figure is a significant decrease on the 2014 result (£24,041),

and well below the £85,858 of 2013. Nonetheless, it is still the highest of any

of the three companies in the sector for 2015. Current Assets are up to £74,439

from £37,421 in 2014. This is, of course, mirrored in the Debtors data, where

the figure rose from £13,380 in 2014 to £55,701. However, in 2014 Debtors comprised

c.36% of the Current Assets, and this

has – rather worryingly – risen to c.75%.

For 2014 and 2015 Fixed Assets have been valued at £0 – a long way down from

the historic peak of £11,720 in 2010. At the very simplest level, this would

suggest that there has been little in the way of investment into the company.

On the other hand, Creditors falling due in more than one year have remained

constant at £0 since 2013. Even when such did exist (2008 & 2010) they were

very modest, in the order of £3,400. At the same time, Current Liabilities (payable

in less than one year) have increased markedly to £34,995 from £7,750 in 2014. Again,

this is much better than the 2013 figure of £90,585. Stock or other assets are

listed at £0, and have been since 2011. Taken together, the Net Worth of FMacM

is listed as £39,444. Although far below the £90,548 of 2008, or even the

£61,611 of 2013, this is still a good result, making FarrimondMacManus (by far)

the most valuable company in the sector.

Northern Archaeological Consultancy (NAC)[The 1997 Co]

Finally, we come to Northern

Archaeological Consultancy whose directors are listed as Alan Reilly,

Stephen William Gilmore, and Colin David Dunlop. At the end of 2015 NAC had all

of £2,629 Cash at Bank. This was a marginal improvement on the £1,534 of 2014,

and especially the £325 of 2013, but far below the heady results of £49,531

recorded in 2007. Their Current Assets are £68,461, down from £78,525 the previous

year and the £99,059 of 2013. Once again, these figures are all quite

insignificant in comparison to the historic high of £308,049 from 2007. Again,

the story of the Current Assets is tied to the company’s Debtors. In 2015

Debtors were valued at £47,861 and made up 69.91% of Current Assets. The value

of the Debtors has been falling from £74,747 in 2013 (75.46%) to £50,491 in

2014 (64.30%). It is easy to suggest that a fall in the amount owed by clients

is a good thing, indicating that the company has been successful in collecting

debts. However, it may also be taken as a broad indicator of the volume of work

undertaken by the company, and a three-year decline (paralleling the 2008-2012

economic downturn) can only be regarded with concern. Fixed Assets are listed

at £3,489. This is down slightly from £4,653 the previous year and markedly so from

2007’s £20,923. This would suggest that the slight investment noted in 2014 has

not been sustained and that it was but a blip in a larger, downward progression

of non-investment since the beginning of the economic downturn in 2008. On the

positive side, NAC list their Creditors requiring repayment more than one year

in the future at £0 (the same as 2014). This is a major recovery from historic levels

of debt in the region of £31-35,000 recorded in 2012 and 2013. The company’s

history of Current Liabilities is rather more turbulent. At the end of 2015 these

were valued at £68,430, an increase from £61,130 the previous year. All this is

rather small beer in comparison to 2006’s £137,754, but the general trend since

1998 has been towards increasing levels of Current Liabilities. The value of

Stock or other assets is given as £17,971. The period from 2012 to 2014 had

seen this figure remain relatively stable, in the range from £24-29,000, and

this represents a noticeable dip. Once again, these appear as minor

fluctuations in comparison to historic highs of £132,010 recorded in 2008 and

even £107,202 in 2006. Obviously, these variable results have a direct impact

on the current Net Worth of the company. At the end of 2015 NAC’s Net Worth was

listed as £3,520 – a massive and worrying drop from £22,048 the previous year.

Indeed, the period from 2010 has been exceptionally unstable for the company,

with Net Worth fluctuating between positive and negative valuations. These have

ranged from 2014’s £22,048 down to -£23,735 in 2011. While the trend over this

period has been (broadly) going upwards, the degree of volatility can bring

little comfort or hope for security. In any case, these results are far below

historically high Net Worth valuations of £200,667 in 2007 or even £187,796 in

2008.

Conclusions

While the overall picture

is ever so slightly hopeful for the commercial archaeology sector in Northern

Ireland, the individual companies are not contributing equally to that image.

The underlying point of this exercise is – as always – to ask how safe and

secure are the artefacts and archives these companies hold. This is the

physical evidence of our ancient past, part of our shared cultural identity,

and the deep history of this land. If one of these went out of business the

possible losses to our shared heritage could be catastrophic. We have already

seen ADS apparently wind up its operations in Northern Ireland (though their

status in the Republic of Ireland appears to be different) with no apparent

intervention from the Northern Ireland Environment Agency to protect or rescue

material from this jurisdiction. At this time, I have no knowledge of the fate

of these items, though I can only imagine that it must be rather perilous if

there is no active company involved in their curation. Despite modest (though

variable) profitability in the remaining consultancies, their fates and

finances of none are secure, and it is likely that at least one could have

ceased trading within the medium term. Should this happen, there is absolutely

no guarantee that the loss of jobs involved will not be mirrored by a loss of

our shared cultural heritage. Once again, we can but wait to see what the 2016

accounts bring … are we witnessing the green shoots or recovery or the death

rattle of an entire sector?

This is my analysis. It

is based on the available figures submitted by these companies in their end of

year statements of accounts. However, there may be more in the data that has

not registered with me. Please feel free to use the Tableau dashboard below to examine the data in ways meaningful to you and make your own discoveries.

Comments

Post a Comment