‘Someone's gotta help me dig’: going deeper & longer into the rise and fall of commercial archaeology in Northern Ireland

[If you like what I write, please consider throwing something in the Tip Jar on the right of the page. Alternatively, using The Reading Room portal (top of page) for shopping with Amazon brings in some advertising revenue and costs you nothing]

< Appendix

Introduction

At the end of 2015 I

took a look at the financial health of the Northern Irish commercial

archaeology sector (Another

turn round the plughole? Commercial Archaeology in Northern Ireland in 2014).

This, in turn was a follow-on from two previous posts on the topic, chronicling

the post 2008 collapse of the market and its sustained failure to recover [here

| here].

These posts have made use of the publicly available data submitted by these

enterprises as part of their end-of-year accounts and hosted by, for example, Company Check. The available data was

time limited, only going back to 2007 – and that only for one Company. For the

other three NI Companies, the data only started in 2008, as the crash happened.

I’ve long hoped for a means of pushing this back to gain a deeper time context

to the rise and fall of the sector. The other point I would make here is that

my analyses had been based on four easily accessible KPIs: Cash at Bank;

Current Assets; Current Liabilities; and Net Worth. There is an awful lot to be

said for working with this rather high-level data, not least of which is that

it allows simple and clear understandings, even if it is at the cost of

fine-grained detail. Since the last time I took on the task of writing about

the financial decline of the Northern Irish commercial archaeology sector I

worked closely with the people at CompanyCheck to address both of these issues –

time depth and level of detail – to produce a new interactive Tableau dashboard.

While the folks at CompanyCheck have been very helpful, this assistance has an

attached cost and I would amplify my usual plea for donations: if you like this

post and find it useful or interesting, please consider donating via PayPal.

The button is in the top-right corner & all assistance would be

appreciated! Also, before you continue reading this post, or interacting with

the Tableau dashboard, I would suggest that you read ‘The Dashboard’ section of

the post dealing with essentially the same situation for the Republic of

Ireland [here].

Finally, I would reiterate that although I originally took the position that I

did not want to directly identify companies (instead preferring to refer to

them by the year of their incorporation) the legal advice I have received is

that I should provide some linkage to allow fact checking and allow for

meaningful rebuttal. To this end, I have created an appendix [here]

where the interested reader can link directly to the underlying company data.

|

| Screenshot of the current state of the Tableau visualisation |

What’s new?

The first thing that

the reader should note is that the available financial data now stretches back

to 1998, when only two companies operated here (the 1990 Co. & the 1997 Co.).

Obviously, the number of available sets of accounts increase in the years after

the establishment of the 2002 and 2005 Cos. The other point of note is that the

Key Financials control now has several additional categories of data. On top of

the KPIs I’ve used previously (Cash at Bank; Current Assets; Current

Liabilities; and Net Worth), there are Creditors

>1y (i.e. Creditors that are

not due to be repaid within the current financial year. In many cases these

would appear to represent bank loans etc.).

This represents a division of the data between long- and short-term company debt.

For clarity, the former Current Liabilities KPI is now referred to as Current Liabilities <1y. The other

new KPIs are Debtors; Fixed Assets; and Stock/Other (this last category includes the value of work in

progress but not paid for etc.). The

older Key Financial of Current Assets is seen to be a combination of Cash at

Bank, Debtors, and Stock/Other. As a final note, at the time of writing, one

company had submitter 2015 accounts, I have chosen to include these too.

|

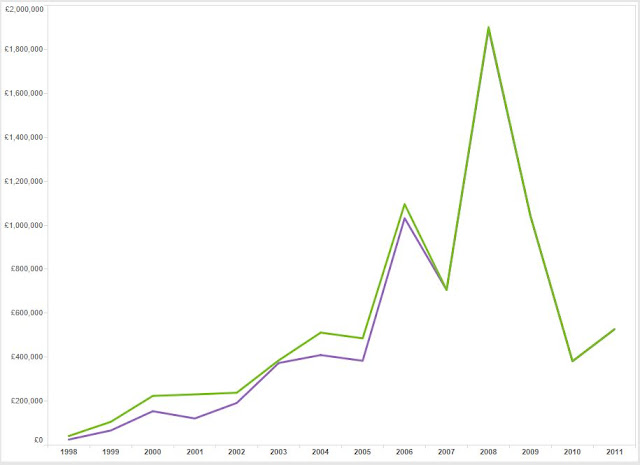

| 1990 Co. Current Assets & Debtors Data, 1998-2011 |

The 1990 Co.

I’ve written

extensively about the financial affairs of the 1990 Co. in the past [here].

Between this and the fact that they haven’t submitted accounts since 2011, I’m

not particularly keen to go over the same ground once again. To the best of my

knowledge, this company appears to have laid off all its staff and now exists only

as a small-scale owner/operator endeavour. Nonetheless, it is instructive to

look at the Current Assets and the Debtors data in combination. When the data

is examined closely, it is clear that the Current Assets of the company are

largely made up of monies owed to them (Debtors). While money owed to you is

always a positive commodity, it is hardly a safe one. Anyone familiar with the

difficulties of getting developers to pay for archaeological works will be aware

of how flimsy an asset this can be. While point-blank refusal to pay and a

general inclination to ignore demands for payment have long been standard fare

from the clients of archaeological companies, the 2008 economic downturn saw

many developers – both large and small – file for bankruptcy and cease to

trade. It is for this reason that I have included a ‘tooltip’ of ‘Debtors as a

% of Assets’. Hover over any data point when a single company is selected and

this percentage will be displayed (because of how Tableau works, competing

values from multiple companies will result in an asterisk being displayed). In

the case of the 1990 Co, we can see that from 1998 to 2006 Debtors made up a

substantial proportion of the company’s assets, but not the entirety of it. This

ranges from 52.5% in 2001 to 96.9% in 2003. However, from 2007 the values have

been so close that the two lines are indistinguishable, ranging from 99.54% in

2008 to 100% in 2011. In absolute terms, there is a vast drop in the value of

debtors from £1.9M in 2008 to £381K two years later. Without access to further

data, it is impossible to say if this represents evidence of either the payment

of these outstanding debts or them being written off (in whole or in part) as

unrecoverable.

|

| 1997 Co. All KPIs, 1998-2014 |

The 1997 Co.

In my past analyses the

available data for the 1997 Co only went back as 2008, but with the additional

information now available, this can be extended back to 1998. This adds a

number of interesting perspectives that had not been previously available. For

example, the Cash at Bank in 2008 was £33K, but we can see that this was

already falling from £45.9K the previous year. More surprisingly, 2007 appears

to have been the first really successful year for this outfit as Cash at Bank

totals only rose above £0 in 2001 (£3K) and 2002 (£315). Their 2012 accounts

indicate that they had a debt of almost £36K coming due in more than one year.

Although the exact nature of this debt is unclear, it was reduced to £31.5K by

the following year and appears to have been completely discharged by 2014. A

comparison of the Current Assets against the company’s debtors is instructive,

especially in contrast with the data from the 1990 Co. Here Debtors made up the

Current Assets from between 17% (2001) to 89% (2011). Many of these are

substantial percentages of the Assets, but the never ventured into the range of

the 90%s, or even the 100% that the 1990 Co. recorded in 2011. Then again, in

absolute terms, we’re talking about vastly different figures – in 2007 the

Current Assets of the 1997 Co. are listed at £308K, while the 1990 Co. (having

a downturn) had Current Assets of £706K. Similarly, the 1990 Co. had total

Current Assets of £1.9M in 2007 against £260K for the 1997 Co. We’ve not

previously had any insight into the fixed assets of the companies, so it is

interesting to now see that in the period from 1999 to 2004 this was in the

range from £3K to less than £5K. However, there was obviously some serious

investment as over the course of the next three years the value of Fixed Assets

soared to £21K (2007) with a rapid decline thereafter. This decline is most

probably the result of accounting depreciation, though shedding of assets may

also have been a factor. The steady decline to a low of less than £3K in 2013

shows that there had been little, if any, investment over that period. The latest

(2014) figures show an uptick to £4.6K but, while significant in the face of a

long-term decline, is hardly evidence of a strong recovery.

|

| 2002 Co. All KPIs, 2003-2014 |

The 2002 Co.

Like the 1997 Co.,

records for the 2002 company were only available as far back as 2008, but now

goes back as 2003, the first year where they would have been obliged to produce

accounts. We can now see that, judged by the Cash at Bank totals, this company

had their two best years in 2006 (£82K) and 2007 (£68K), easily outstripping

their previous known best of £51K in 2009. We can also see that the company had

a Creditor (>1y) of nearly £8K in 2006, but this was reduced to £3K the

following year and appears to have been fully paid back by 2008. Again,

comparing the percentage of Current Assets made up of Debtors is instructive as

they parallel each other so closely, moving from a minimum of 60% in 2007 to

99.6% in 2008. In absolute terms there is a massive fall off in Current Assets

from 2008 (£376K) to 2013 (£27K) that may be the result of Debtors paying their

debts, or certain sums being forcibly written off as unrecoverable bad debts.

While I can speak with no authority on this point, it would seem likely that in

the post-2008 financial landscape one of these scenarios is more likely than

the other. Finally, an examination of the Fixed Asset data shows strong

investment from £6K in 2005 to just over £37K in 2007, but with continued falls

ever since. As noted above, in connection with the 1997 Co., this is more

likely due to accountancy depreciation than disposal of assets. While this may

be a ‘natural’ practice, the unbroken fall would appear to indicate a 7-year

long hiatus in investment. I find little in this to cause anything other than

worry for the future.

|

| 2005 Co. All KPIs, 2006-2015 |

The 2005 Co.

The new data adds two

further years of accounts to those already available for this company, bringing

it back to 2006, the earliest they could have been expected. While this data

doesn’t add a vast amount to what we already know about their financial health,

they are the only one of the four companies to have submitted 2015 accounts. We

can see that they had two very successful years in terms of their Cash at Bank

in 2009 (£70K) and 2013 (£86K). I think it is fair to say that the latter cash

surplus was – in large part – due to their winning and maintaining the contract

to supply archaeologists to a significant and high-profile wetland excavation.

However, that amount fell to £24K in 2014 and dipped to under £19K in 2015. The

figures also show Creditors >1y with a debt of £3.5K in 2008 and 2010,

though this appears to have been completely cleared by 2013. Analysis of the Current

Assets against the Debtors shows a much more conservative relationship between

the two than in other cases. At best, Debtors made up only 30% of the Current

Assets in 2009, and as high as 82% in 2012. According to the 2015 returns, the

company has Current Assets of £74K, of which 75% (£56K) is made up of moneys

owed. The 2013 returns showed that this operation had accrued Current

Liabilities due within one year of £90.5K – presumably in line with their

higher operating costs and higher income – and that this had fallen to under

£8K the following year. For 2015 Current Liabilities crept up to £35K, again

presumably in line with income and increased operating costs. Fixed assets tell

a story of sustained and continuing investment in the period from 2007 (£1.5K)

to 2010 (£12K), but with generally falling values down to £0.00 in 2015. Within

this time period, the greatest single drop was from the £12K noted for 2010 to just

£2.2K in 2011. While depreciation of fixed assets is to be expected, this

ongoing fall suggests a complete lack of inward investment over recent years.

The final KPI I’m going to examine in this post is Net Worth. As discussed in

previous posts, this fell from highs of £90K in 2009 to under £10K in 2010.

Despite their rise to £62K in 2013 – a peak that bucked the trend for the rest

of the sector – they fell back to just under £30K the following year. 2015 has

obviously been better and the 2005 Co.’s Net Worth has recovered to £39K. As

the only company to have submitted accounts that are available for examination,

it remains to be seen if this reflects an industry-wide recovery, or (like

2013) a single-company surge.

|

| Average of all KPIs for all companies, 1998-2015 |

Overall picture & the future ...

Looking at the average

picture for all companies it is tempting to read the 2015 data as an indicator

of recovering revenues and improving fortunes for the commercial archaeology

sector. However, it is simply too early to draw any such conclusions. However,

the additional historical data allows us greater context to see spikes in Cash

at Bank in 2001 (£38K), 2007 (£35K), 2009 (34£K), and 2013 (£30K). Average

Creditors >1y (i.e. bank loans and

interest thereon) have been relatively modest with particular spikes in 2006 (£15K),

2012 (£12K), and 2013 (£11K), though all appear to have been repaid by 2014. As

noted before, there is a defined spike in average Current Assets (with a

corresponding surge in the value of Debtors) in 2009 that has been generally

falling in the time since. While the 2015 values would indicate increases, they

are only slight and don’t even match the 2013 values. Average Current

Liabilities <1y show a jagged plunge from £19K in 1998 to £0.5M in 2008. The

story since then has been of an equally jagged reduction in debt to £35K in

2015. The average values for Fixed Assets shows significant investment from

£11K in 2003 to £33K the following year. This, essentially, plateaued until

2007 (£32K), before going into steep decline ever since. While some of these

KPIs show significant negative change in 2008 and 2009, this indicates that (at

some level) investment in the companies effectively ceased a year earlier. The average

Net Worth of the sector is interesting and of vital importance in understanding

where commercial archaeology in Northern Ireland is at the moment. As all the

previous discussions on this topic have shown, it reached its zenith in 2009

with an average Net Worth of £195K, before plummeting to just £6.4K the

following year. Despite some improvement in 2012 (£9.5K), this fell again to

-£5K in 2013 (this despite the exceptional year for the 2005 Co.). This

recovered to £3.4K in 2014 and, albeit based on one set of accounts, this has

increased by more than an order of magnitude into 2015. I can’t repeat it

enough that this latest data is from only one company and cannot be relied upon

as a reflection of the industry as a whole. Even if this accurately and

adequately reflects the reality of the situation, it shows how far below the

best years of 2008 and 2009 the industry still remains.

My original point when

I started this analysis remains the same as it is today – to assess how robust

the sector is and – by implication – how safe the excavated remains of our

shared heritage are. Simply put, if one of these companies goes under there are

no safeguards in place at a governmental level to ensure that this material –

artefacts, ecofacts, along with written and digital archives – do not end up in

a skip, being transported to landfill. Despite the apparent return to

profitability seen from one set of accounts, there is no greater reason for

hope than there has been for some time. I still believe that the long-term safety

and security of our excavated past remains hanging by the narrowest of financial

threads.

As always, the Tableau

visualisation below (or directly available on the Tableau Public server here)

is interactive and will allow the reader to drill down into the data for their

own analyses.

Notes

For the best viewing experience of the Tableau dashboard, I would recommend going to Full Screen mode (F11) … there will be less scrolling needed!

The title of this piece

is taken from Father John

Misty’s song Hollywood Forever Cemetery

Sings, from his ground-breaking 2012 album Fear Fun [also: here]. But, of course,

you knew that.

< Appendix

Comments

Post a Comment